Jet 2 Fund for Qualified Investors

We manage EUR 157 million for the fund’s investors

The Jet 2 Fund was fully funded in 2021, and its 2-year investment period ended at the same time. About 160 private and institutional investors from the Czech Republic and abroad have entrusted their money to the Jet 2 Fund.

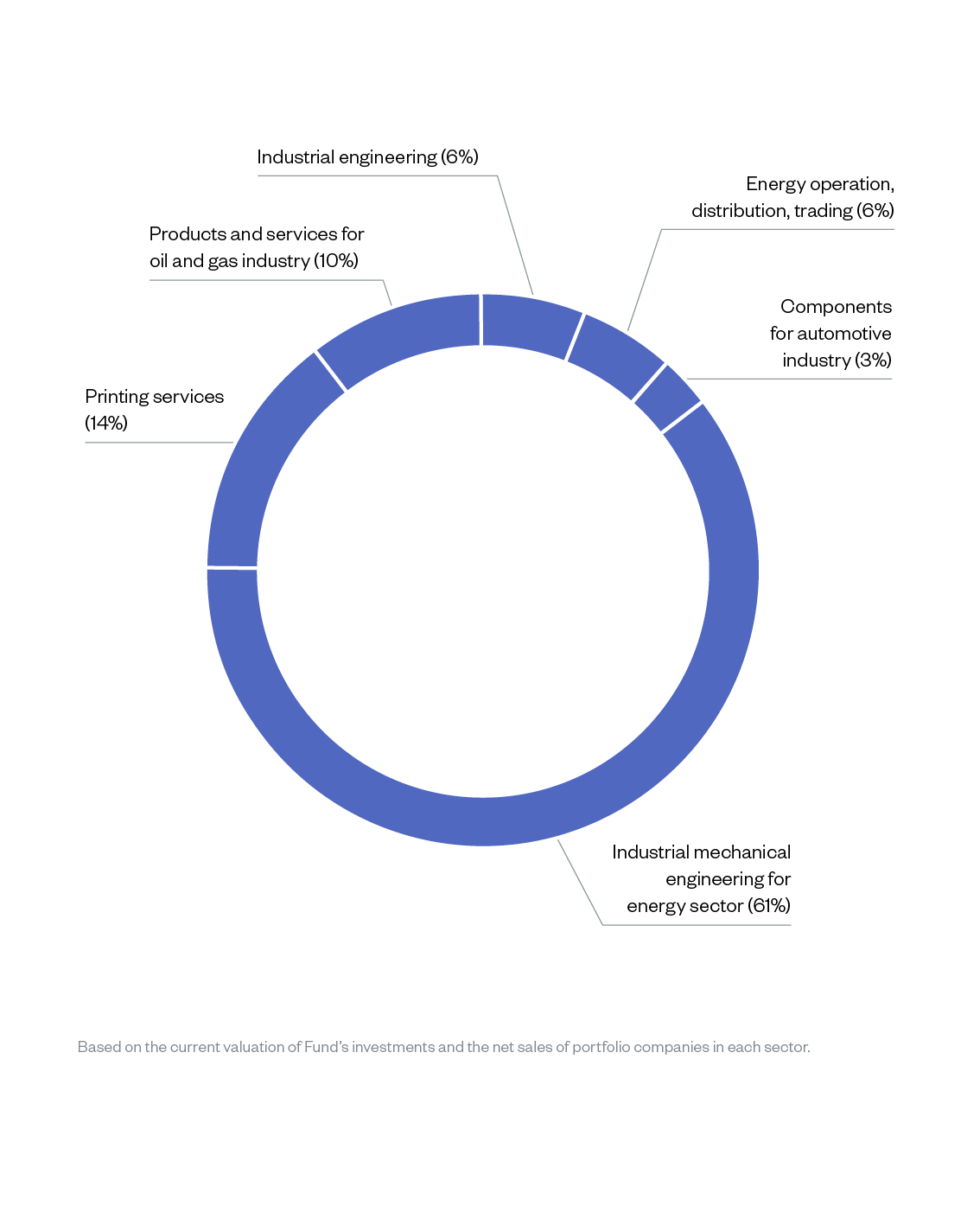

The fund’s portfolio is a mix of small and medium-sized companies from the engineering, energy, automotive and printing industries, grouped into three industry platforms. We will target their further growth and returns through to the end of the investment horizon in 2026.

160

INVESTORS

157m

OF INVESTMENT CAPITAL (EUR)

15 %

SHARE OF JET PARTNERS

100 %

DEPLOYED

8-10

YEARS IN INVESTMENT HORIZON

3

INDUSTRY PLATFORMS

Jet 2 Fund Companies

Sector structure of Fund investments

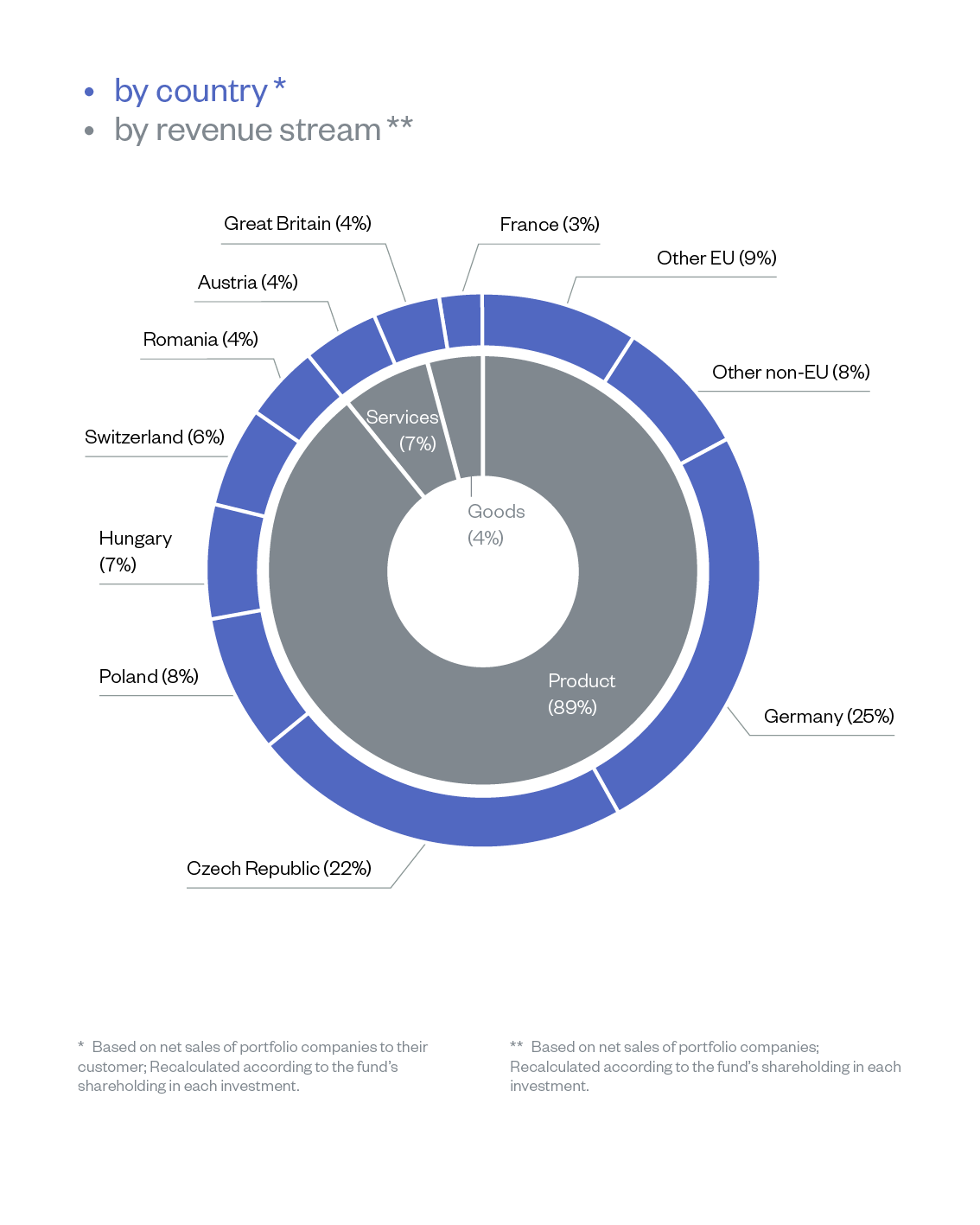

Sales in Fund's portfolio companies